PhilHealth, DOH and DOF urge Senate to approve pending excise Sin Tax bill

June 4, 2019

With the signing of Republic Act 11223 better known as the “Universal Health Care (UHC) Act of 2019” by President Rodrigo R. Duterte on February 20, 2019, the Philippine Health Insurance Corporation (PhilHealth), the Department of Health (DOH) and the Department of Finance (DOF) have joined together in a press briefing to reiterate the need for the Senate to act swiftly on the pending bill on excise tax rates on tobacco and alcohol products.

The Sin Tax law approved in 2012 restructured today's existing taxes imposed on alcohol and tobacco goods. Duties on these products have become a revenue source that help fund the UHC program. Said program, by design, aims to be at par with the world's best health care systems.

Under UHC, PhilHealth as the primary strategic purchaser of health services and leading government agency implementer, is tasked to make sure that all Filipinos are guaranteed access to health care.

Access to health care simply means that all Filipino citizens shall now be automatically included in the National Health Insurance Program (NHIP). No Filipino shall ever be deprived of quality health care based on one’s capacity to pay, but of one’s health needs. Every Filipino should be able to access health care whenever he or she needs it. This is a guarantee being given to each and every Filipino, especially to those who have remained in the margins for the longest time.

"UHC is not free. It costs huge sum of money to fully implement it. We need to make sure that this unprecedented investment for the Filipino is funded sustainably. It will provide coverage to all law abiding Filipinos, reducing vulnerability, lowering out-of-pocket expenses and improving quality of life. It will not be sustainable if there is no additional means to fund it," Finance Secretary Carlos G. Dominguez said in his statement.

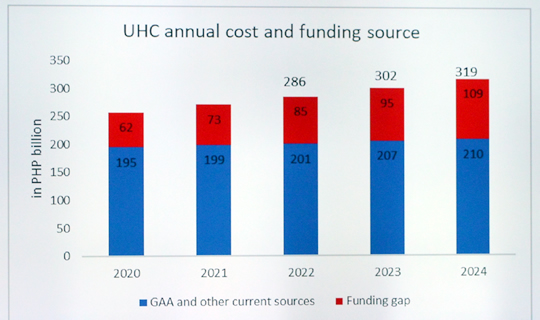

In the first year of its implementation in 2020, the UHC will cost approximately P258 Billion. From the present sources of funding, from the Philippine Amusement and Gaming Corporation (PAGCOR) and the Philippine Charity Sweepstakes Office (PCSO), the government will be able to raise around P195 billion for this program. But without sin tax reform, the program will be left with a funding gap of around P62 billion.

Without the sin tax reform, the cumulative funding gap by 2024 will stand at P109 Billion or above half of the total cost. If new sources of revenue is not established, there will not be enough funds to properly implement UHC. The funding gap can be fully covered if the excise taxes on tobacco and alcohol is increased.

While the Sin Tax bill was made to impose collection of more revenue for health care, it was also for the promotion of health as a deterrent to the consumption of “sin” products, whose adverse effects are mostly borne by the poorer segments of society.

"The ultimate goal of this proposal is to promote public health. Increasing excise taxes on these products will help discourage consumption and lead to better health and social outcomes, especially among the youth and the poor. We hope that the increase in prices will discourage people from buying cigarettes, thereby reducing the incidence of tobacco-related diseases," Health Secretary Francisco T. Duque III said.

The Philippines has an estimated 17.3 million tobacco consumers, the most number of smokers in Southeast Asia. Smoking is one of the leading causes of cancer in the Philippines. Ten Filipinos die every hour because of this, according to DOH statistics.

"Taxing sin products work. In 2012, the sin tax law succeeded in reducing smoking prevalence from 29% in 2012 to 22.7% in 2015. However, recent survey polls show that smoking prevalence has increased again to 23% in 2018. This is a warning sign. With the rise in incomes, and slower increases in tobacco taxes in years, tobacco has again become affordable to the youth and the average Filipino," Dominguez said.

"If we do not significantly raise excise taxes on tobacco and alcohol, the UHC program will begin with a funding gap and may end up with the prospect of ballooning health costs due to related tobacco and alcohol diseases..."Dominguez explained, adding that "Without sin tax reform, PhilHealth members will only continue to be covered for 18 primary care drugs and seven conditions. They will continue to shoulder 90% of the cost of the prescribed medicines. But with sin tax reform, coverage will improve to 120 drugs, and no limit to primary care consultations. DOH wisely proposes that medicine purchases will be limited to fix fee, the cost of the transaction alone. These are just some of the specific benefits that Filipinos will receive in the full implementation of the program."

The DOF Secretary further expressed that facts of this issue were presented to the President and the rest of the Cabinet. The President has agreed to certify the Senate bill as urgent, and gave clear instruction to tax alcohol and tobacco at higher than its current rates to fund the UHC program beginning this year. It has always been the President's goal to ensure that every Filipino family receives appropriate, affordable and quality health services.

PhilHealth, the DOH and DOF expressed that cigarettes be taxed at P60 per pack and alcohol at P40 per liter, at least. (END)

Comments